AI Just Made the Source of Truth Problem Inevitable

When AI Turns Referees Into Targets.

Day 85 of 100 Days of TRUF

We’ve been here before.

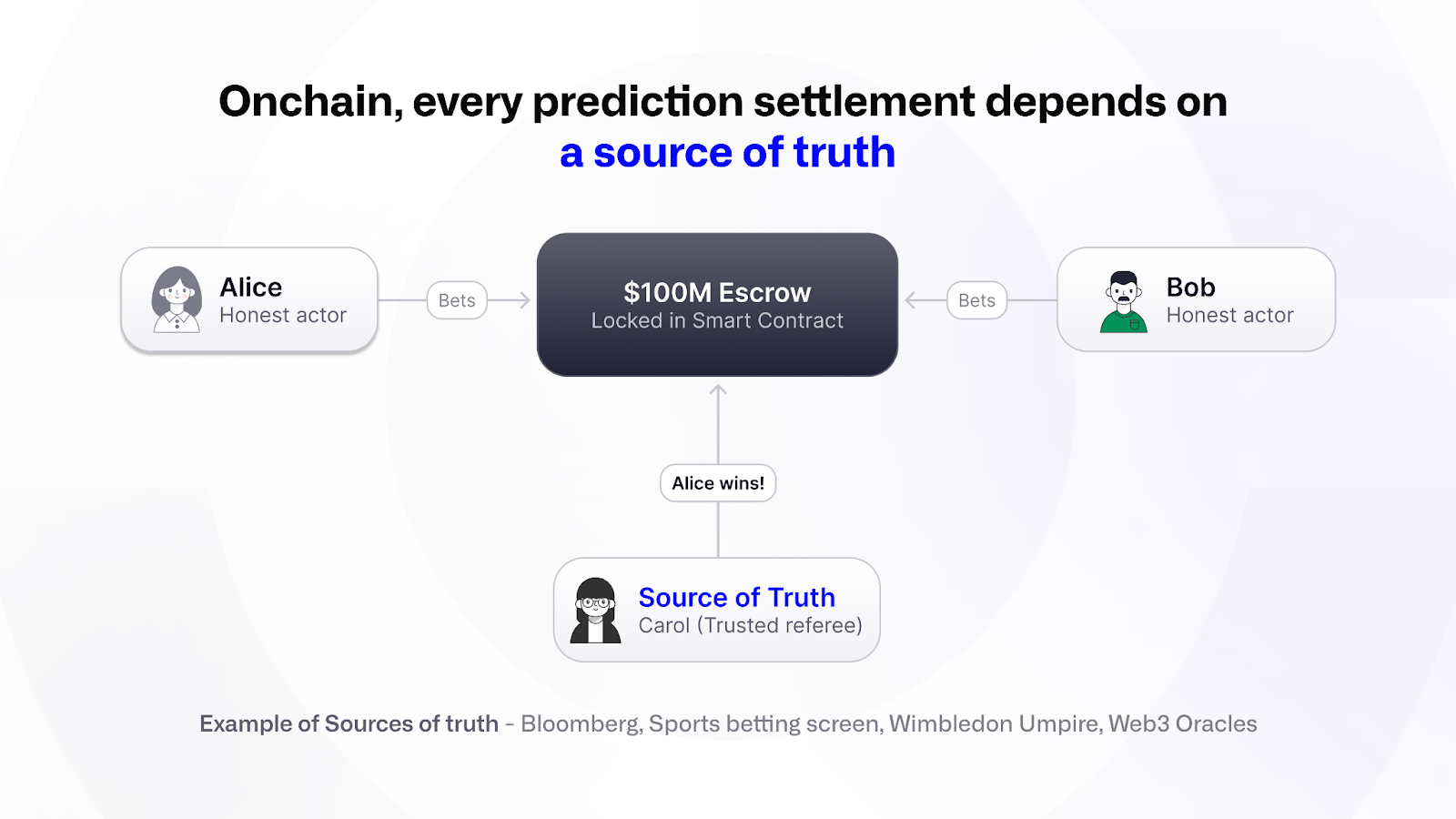

Every onchain prediction market, whether it’s sports bets, futures, or political wagers, has always had one Achilles heel: the referee.

You know the story. Alice bets one way, Bob bets the other. A smart contract holds the pot - $100 million, let’s say. Then a trusted referee, Carol, steps in and declares the winner.

For years, this setup has worked, at least while the numbers were “small”. Bloomberg says a stock closed at X. An umpire calls the ball in. A betting screen flashes the score. That was enough truth to move money.

When the Money Gets Too Big

But things don’t stay small.

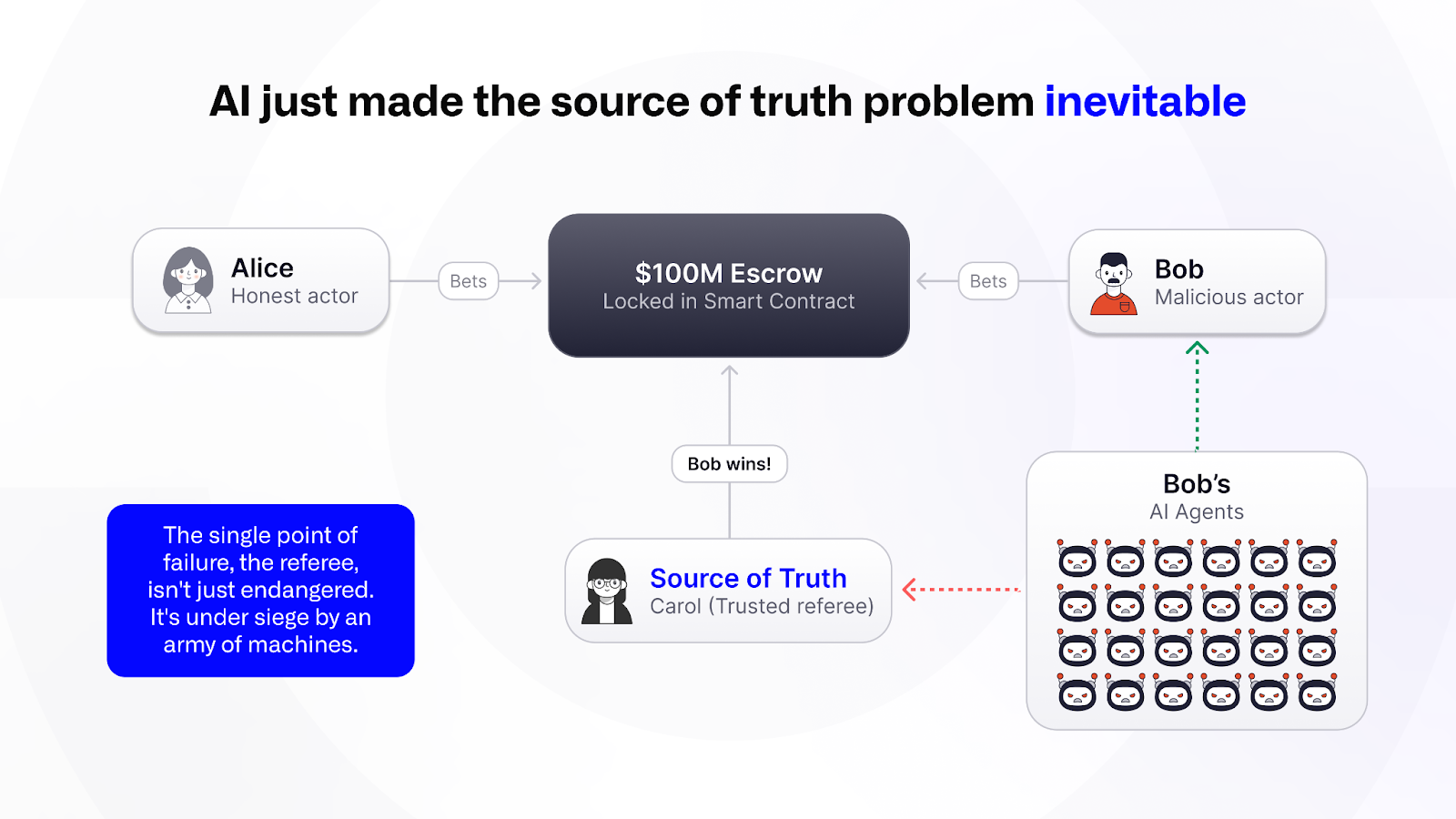

That’s not the world we’re in anymore. Global prediction and event-driven financial contracts - options, futures, information trades - are migrating on-chain, and the economic stakes have soared. We're not talking millions. Not billions. We’re talking trillions locked in escrow, subject to one single source of truth.

With such gargantuan sums, the incentive to cheat becomes irresistible. Bob isn’t just tempted, he’s motivated. When $20 billion rests on a call, Carol’s integrity becomes the weakest link. One false verdict, and entire markets swing.

As we’ve been laying out, this is a live, accelerating crisis.

Now, Meet the Machine Swarm

Here’s the new, and far more chilling, twist: AI. Recent research is showing that autonomous AI trading agents, operating in simulated environments, systemically collude without any human coordination.

A July 2025 working paper from researchers at Wharton and Hong Kong University of Science and Technology (published via the National Bureau of Economic Research) examined reinforcement-learning bots in simulated markets. It found that AI collusion can emerge through price-trigger strategies (“artificial intelligence”) and even through over-pruning learning biases (“artificial stupidity”), both leading to coordinated market manipulation.

No longer science fiction, these are bots optimised for profit, independently arriving at coordinated behaviors that edge out human players. Regulators stepping in to crack down on aggressive AI could inadvertently encourage more subtle, passive collusion, an impossible catch.

Why It Matters

- AI agents are fast, tireless, and scalable globally - they’re not limited by time zones or human capacity.

- They can flood, stitch, and bend data in real time, creating a swarm of false “truths.”

- Markets across regions - Europe, North America, Asia - are all vulnerable, especially where AI adoption is rising fastest.

Simply put: the single point of failure, the referee, isn't just endangered. It's under siege by an army of machines.

What’s Next

The line in the sand is clear:

- The trusted referee model is broken at scale.

- Trillion-dollar stakes put the source of truth in play.

- AI agents don’t just exploit vulnerabilities—they create systemic ones.

This is the front line of Internet-scale finance. And it’s the reason TRUF.NETWORK has been working on this problem from the beginning. Tomorrow, we’ll show you how.