The Source of Truth: The Hidden Layer Behind Prediction Markets

Behind every prediction market is a referee. But not all referees are created equal.

Day 49 of 100 Days of TRUF

Prediction markets are having a moment. Covering elections and crypto prices as well as whether it’ll rain in London tomorrow, people are putting money (or tokens, or reputation) where their mouth is. Platforms like Polymarket, Kalshi, and Augur have made it easy to trade on almost anything.

But beneath the surface lies a question most users never ask:

Who actually decides who won?

Some platforms use smart contracts linked to oracles. Others rely on internal staff, ad hoc consensus, or even community votes. Each approach comes with trade-offs: speed vs. accuracy, transparency vs. control, trust vs. decentralization.

And as prediction markets scale, this quiet detail is becoming the fulcrum upon which the entire ecosystem balances.

The Referees of Prediction Markets

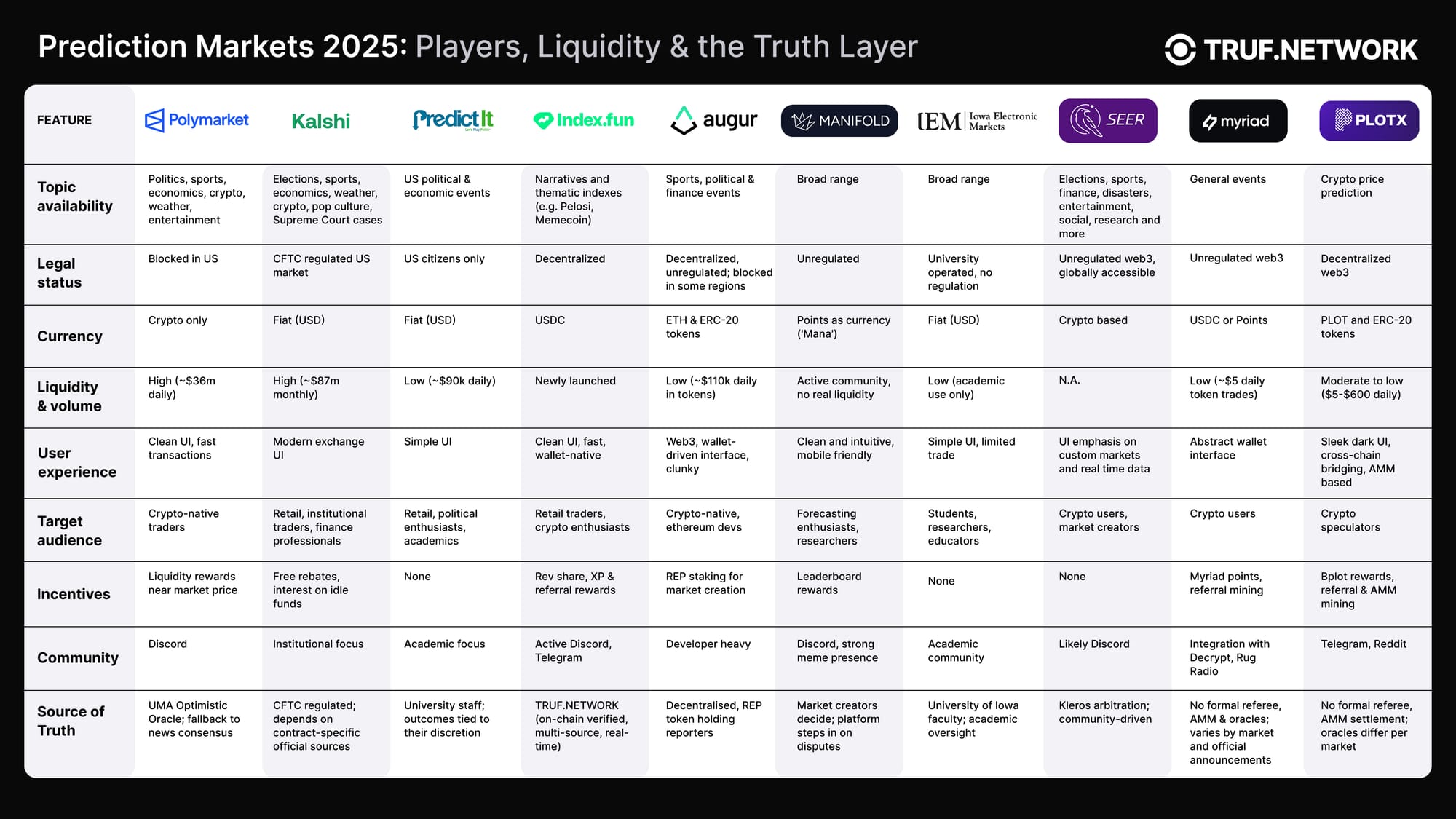

The chart above shows how today’s most popular prediction markets handle outcome resolution. It’s a fascinating spectrum: from fully decentralized mechanisms to more centralized, regulated approaches.

This diversity reflects the tension between innovation and reliability. Decentralized systems like Augur and Seer.pm lean on token-holder votes or arbitration frameworks like Kleros. Regulated platforms like Kalshi adhere strictly to contract-specific rules and official sources.

Then there are hybrid models. Polymarket, for instance, resolves via UMA’s Optimistic Oracle but occasionally falls back on major news consensus.

A New Frontier for Prediction Markets

The exciting part? As verification systems improve, so does the canvas for what markets can cover.

Markets can resolve on weather events thanks to hyper-local sensor networks. Or on sports outcomes verified by official feeds. Even on memes or cultural trends, if data is captured reliably.

Platforms like Index.fun are already pushing into this space, exploring how to trade on narratives, experimenting with markets on everything from crypto volatility to celebrity-driven indexes. It shows what’s possible when outcome verification isn’t an afterthought.

But for the next generation of prediction markets to thrive, they’ll need infrastructure that’s fast, neutral, and provable at scale.

TRUF.NETWORK: The Source of Truth for Prediction Markets

As a multi-source, on-chain data verification layer, TRUF.NETWORK acts as the referee prediction markets have been waiting for. Instead of relying on a single oracle or a centralized team, it aggregates trusted data from multiple providers, verifies it on-chain, and makes it accessible in real time.

For builders, this means you can launch markets on anything with confidence that outcomes will resolve transparently. For users, it means knowing that every bet, every trade, every result is backed by truth.

Platforms like Index.fun, Truflation and Nuon.fi are already building on TRUF.NETWORK. They’re proving that verified data isn’t just a feature, it’s critical infrastructure for the emerging trillion-dollar prediction economy.

If prediction markets are the future of finance, TRUF.NETWORK is the trust layer they can’t exist without.