What the Heck Is an Index - and Why You Should Actually Care

Forget Wall Street. Indexes are the new frontier for gains, built on verified data and on-chain transparency.

Indexes Seem Boring, Until You Realize They Run Everything

The word "index" probably doesn't inspire excitement. It sounds dusty. Bureaucratic. Maybe even rigged. But indexes quietly influence nearly every major decision in our daily lives, whether we realize it or not.

Indexes tell you if it's safe to breathe outside (Air Quality Index),

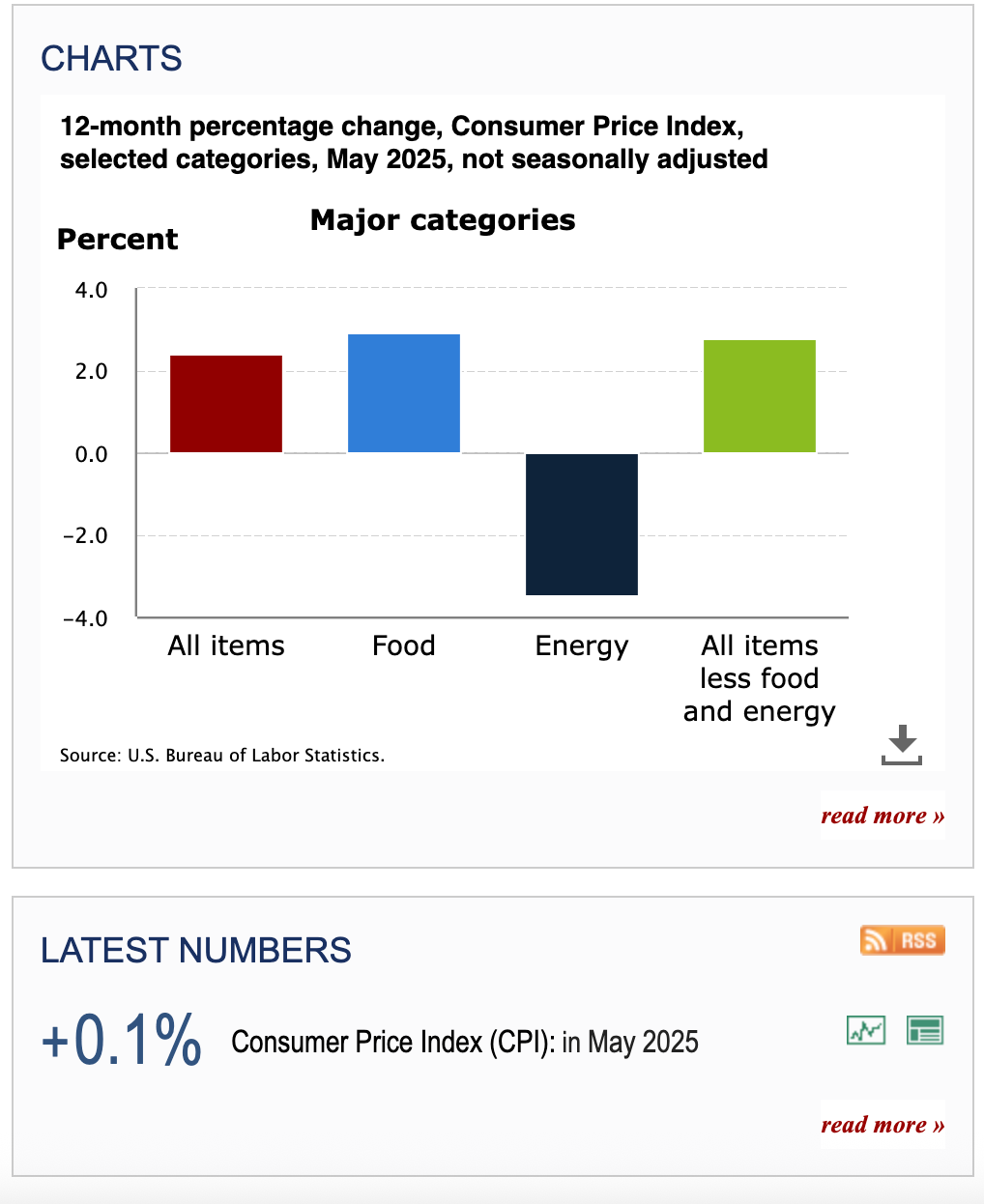

whether prices are rising too fast (Consumer Price Index),

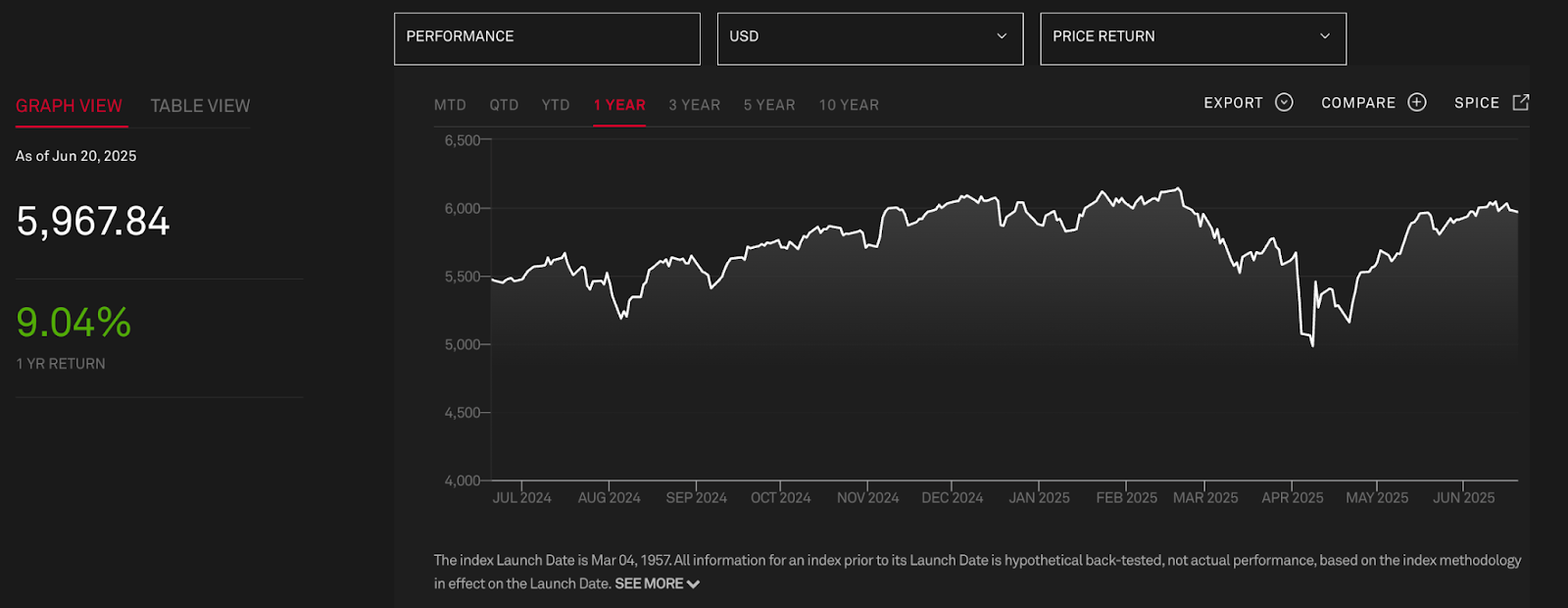

or how healthy the economy is (S&P 500)

Venture capital firms often use innovation indexes to decide which sectors deserve funding. Foundations lean on ESG indexes to prioritize grants. Landlords hike rents based on inflation indexes baked into lease contracts. And when central banks notice that unemployment or CPI has ticked up, they raise interest rates or roll out stimulus packages. These aren’t obscure numbers—they’re levers that move people’s lives. These numbers aren’t just background noise—they steer real-world outcomes.

As Stefan Rust, co-founder of Truflation and TRUF.NETWORK, puts it:

"An index is a story told with data. And right now, most of those stories are written behind closed doors."

2. What Is an Index, Anyway?

An index is a number that simplifies a complex system. Think of it like a movie trailer; it condenses hours of footage into a two-minute highlight reel that tells you what kind of story you're about to watch.

Technically, an index aggregates multiple data points into one signal. It might be a simple average (like a basket of prices), or it might weigh inputs differently based on importance or reliability.

To make this concrete:

- The Consumer Price Index (CPI) combines the cost of goods like food, housing, and fuel to approximate how expensive life is becoming (U.S. BLS CPI or UK ONS CPI).

- The Fear & Greed Index in crypto uses price momentum, volatility, and social media trends to measure investor sentiment.

- The Truflation US Index measures real-time inflation using verified, independent data sources. Unlike the traditional CPI - which is published monthly and subject to political influence - Truflation updates daily, with every data point traceable on-chain. It’s transparent, tamper-resistant, and delivers insights with an approximate 45-day lead over official government figures.

- Spotify’s Popularity index is a real-time popularity index for music, artists, and albums; aggregating data from streams, skips, and listener engagement across different regions to capture what's resonating around the world.

Indexes are how we make sense of chaotic systems. But the power lies not just in what they show, but in how they're made.

3. Indexes Drive Decisions - So Who Controls Them?

Indexes aren’t just analytical tools. They’re decision engines.

- Central banks use inflation indexes to raise or cut interest rates.

- Traders use volatility indexes to speculate or hedge against inflation

- Governments use GDP indexes to justify policies.

- Investors use ESG indexes to allocate capital (sometimes without realizing how fuzzy those numbers are).

The problem? Most of these indexes are built as black boxes. The data is curated, smoothed, and sometimes manipulated to tell a desired story.

Stefan Rust says it plainly:

"People trust indexes that don't deserve their trust - because they don't know how they work."

This opacity isn’t just inconvenient. It’s dangerous. Because when a handful of actors control the dashboards, everyone else is flying blind.

4. Enter: Decentralized, Transparent Indexes

So what if the model was turned inside out?

Imagine indexes built on-chain, using open data feeds. Imagine knowing exactly what inputs are used, how they’re weighted, and where they come from. Imagine tracking updates in real-time and even challenging bad data.

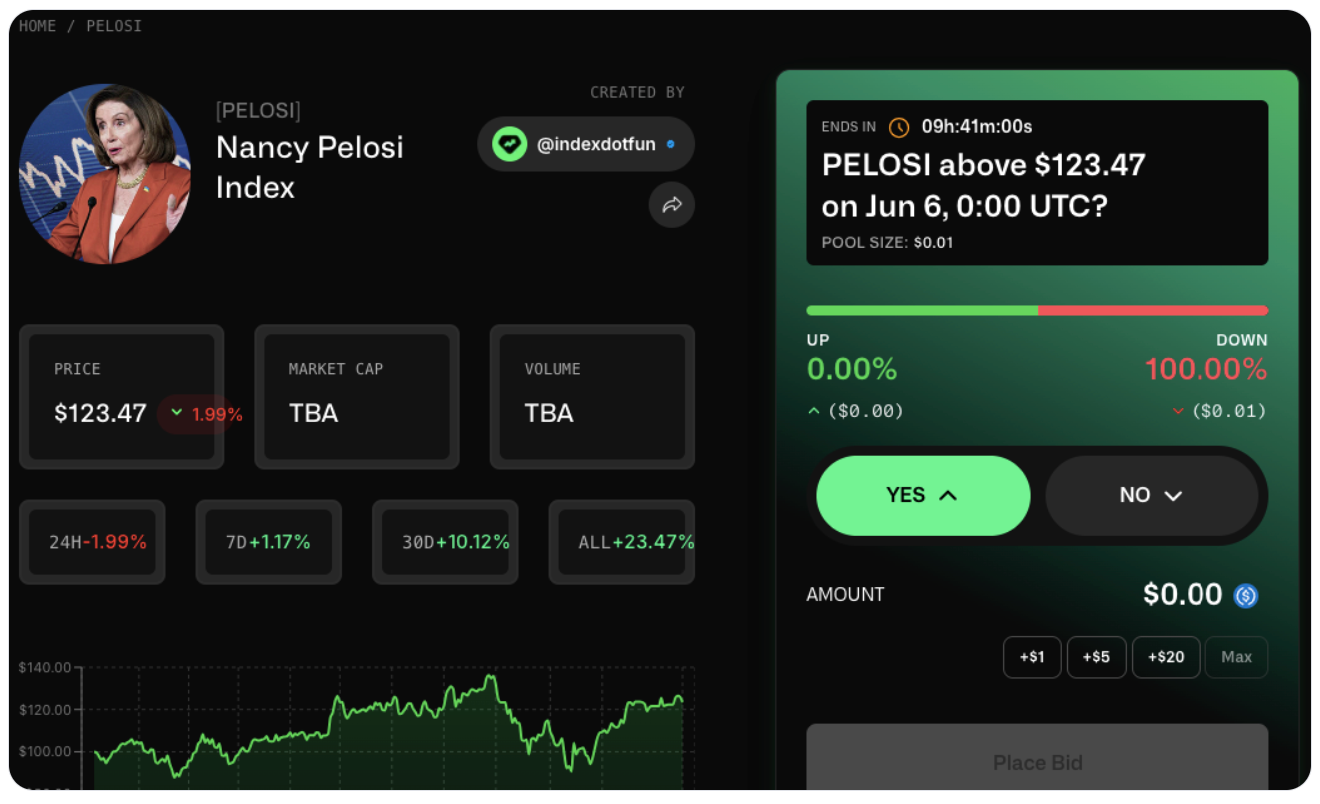

Here’s the twist: with the rise of open data and decentralized networks, anyone can now build their own index.

You can build custom indexes with TRUF.NETWORK’s infrastructure partner, Index.fun.

To learn more, subscribe to our early index creator list

This isn’t theoretical. A new wave of protocols is emerging, enabling:

- Plug and play with verified data streams (weather, sentiment, prices, votes)

- Easy creation of indexes that combine various market signals and provide an invaluable source of information

- Publishing custom indexes that can be traded, mined for info, or used in dApps, dashboards, and prediction markets

Think of it as going from the Bloomberg terminal to the GitHub of economic signals.

Learn more about Index.fun custom index creation tools.

5. Why You Should Care (Even If You’re Not a Quant)

If you’re a builder, creator, trader, or even just a curious observer, indexes are now a valuable tool you can build and use for research and passive income.

-

Are you a data provider with unique data feeds like satellite imagery, point-of-sale retail data, air quality sensors, crop yields, gaming platform analytics, on-chain events, local weather stations?

You can now tokenize that signal and make it indexable. -

Are you an analyst or a researcher?

You can now create unique models, publish them transparently, and earn subscription or usage fees. -

Do you follow prediction markets?

First, you need indexes that quantify trends you want to trade on: like real estate prices, insurance outcome, supply bottlenecks and more. -

Are you involved in DeFi Governance?

Custom indexes can track voter turnout, contributor engagement, and treasury sustainability across DAOs.

As decentralized networks grow, so does the need for reliable signals. That’s what indexes provide – and now the tools exist to help you create them, for example, truflation.com and Index.fun, that both use TRUF.NETWORK technology stack.

And here’s the kicker:

Building indexes isn’t just intellectually satisfying – it can be economically rewarding.

Creators can monetize their indexes through subscriptions, licensing, or by plugging them into prediction markets and financial products.

It’s not just about trading on signals – it’s about getting paid to generate them.

6. Building With New Tools (Without Shouting About It)

Under the hood, TRUF.NETWORK offers the scaffolding for data and index interoperability. Want to mix token price feeds with rainfall data and Twitter sentiment? There are oracles, APIs, and modules for that. Want to publish an index transparently and immutably? Just deploy it on-chain.

And soon, platforms like Index.fun will enable users to create their own indexes plug-and-play-style, without needing to know Solidity or advanced math.

It’s like Canva for economic signals.

In fact, it’s already happening. Early experiments on Index.fun include:

- The Pelosi Index, which tracks the performance of stocks associated with disclosures by the U.S. congresspeople.

- The Deadlift Index, created by @levelsio and Truflation, which links fitness data of major CEOs with their companies’ financial performance.

- Experimental meme and sentiment indexes that follow viral global narratives trending on crypto Twitter and Reddit.

Index.fun creation feature is launching soon – and you can sign up for early access here.

Indexes aren’t just about measuring reality anymore. They’re how we shape it.

7. The Long Tail of Truth

The most exciting part? We haven’t even scratched the surface of what’s possible.

Imagine:

- A Local Food Price Index built by community markets in rural Africa

- A DAO Stability Score, measuring the fiscal and governance health of decentralized organisations

- A Real-Time Sentiment Index for open-source projects

- A Climate Action Index powered by distributed weather stations and citizen science

Why does this matter?

Because indexes shape capital allocation, insurance pricing, and regulatory decisions. Right now, those levers are pulled by institutions. But with TRUF.NETWORK and platforms like Index.fun, anyone can participate in shaping how we measure the world.

Indexes were once the tools of the few. Now they’re yours to create, trade, and build verifiable trust around.

But more than that, they’re yours to profit from, remix, and govern.

Instead of waiting for someone else’s opaque formula to dictate reality, you can build your own, and get paid for it.

You can define the rules instead of reacting to them.

You can bring transparency to systems that have lived in the dark.

So next time someone says "index," don’t roll your eyes.

Smile.

Because now, you get to build and own the signal for the global decision-making infrastructure.

Join index.fun creator waiting list and be the first to build indexes using TRUF.NETWORK-verified economic data secured by TRUF.