When Pizza Orders Signal DEFCON 1

What starts as a quirky dataset becomes a tradable signal once it’s locked into TRUF.NETWORK.

Day 98 of 100 Days of TRUF

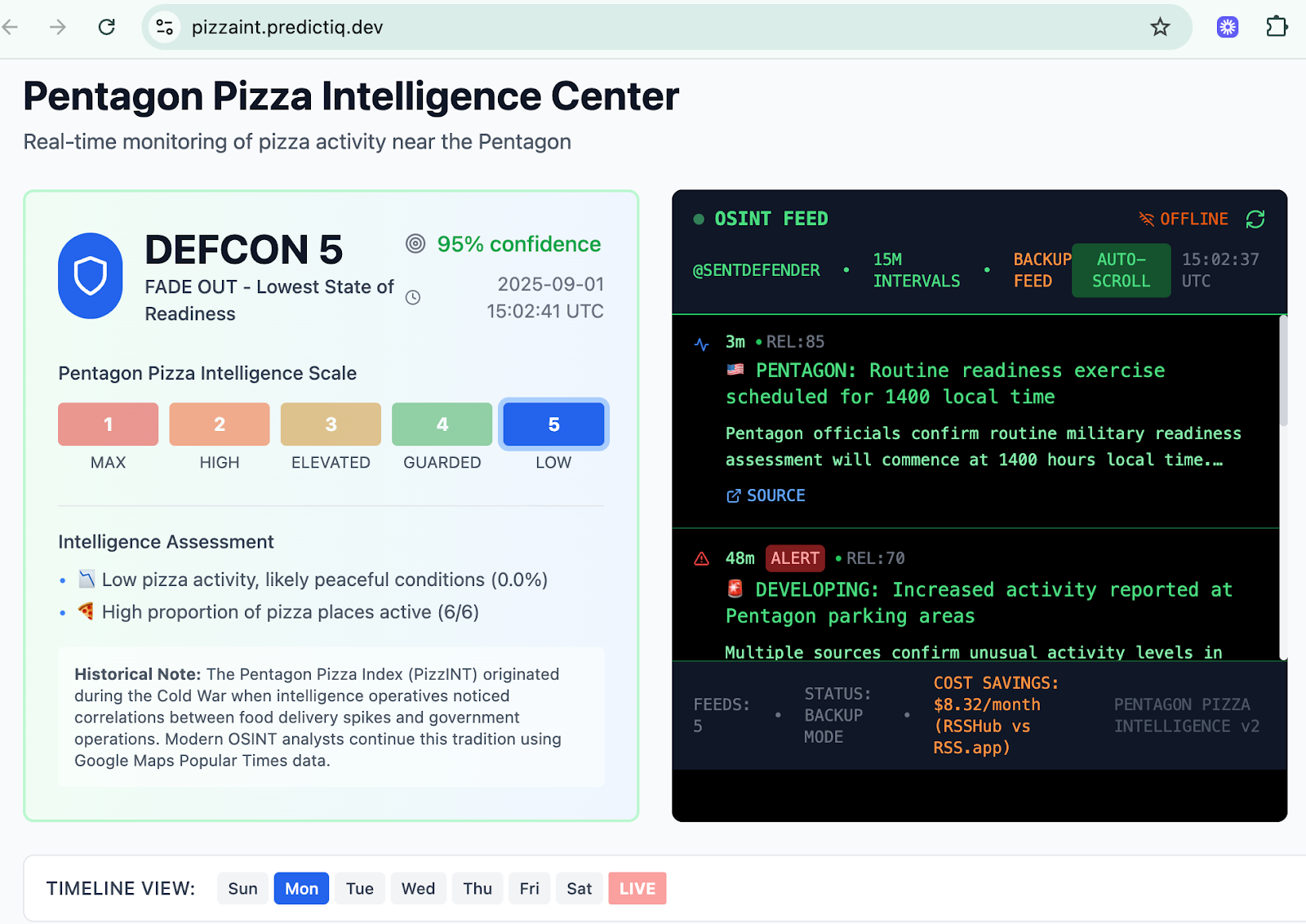

ix pizza shops sit around the Pentagon. Domino’s, Papa John’s, Extreme Pizza, you know them, the usual suspects. A developer wired up a feed to track how busy they are, in real time.

That’s the Pentagon Pizza Index: raw activity data from delivery joints within a two-mile blast radius of the world’s most secure office park.

But here’s the move: those pizza counts get piped into an algorithm that spits out a DEFCON status. One layer deeper, and the index goes from “Domino’s is slammed” to “the U.S. military is probably running an exercise.”

That’s the DEFCON Index: an interpretation layer built on top of raw streams.

Data Layer → Index Layer → Market Signal

This is the playbook.

- Streams measure the world.

- Indexes give them meaning.

- Markets trade on the signals.

Today it’s Pentagon pizza. Tomorrow it’s container traffic in Shanghai, or TikTok mentions of a new sneaker drop.

The point isn’t the toppings. It’s the stack.

Why TRUF.NETWORK Makes It Real

Without infrastructure, projects like this are just fun hacks. With TRUF.NETWORK, they become verifiable assets:

- Provenance locked: You’ll know the DEFCON Index came from this developer.

- Compilation exposed: Sources, weights, and logic are on-chain.

- Schedule enforced: Updates arrive when they’re supposed to.

That’s the difference between a blog post and a billion-dollar settlement layer.

Info Finance, Served Hot

Markets thrive on signals. The earlier, the cleaner, the more trusted, the more money flows. Once indexes like this sit on TRUF.NETWORK, they can be plugged straight into apps like Index.fun, turning Pentagon pepperoni into prediction markets before CNBC even blinks.

The Pentagon doesn’t publish DEFCON. But its pizza joints kind of do.