Who Gets to Say What’s True?

The systems you rely on for financial truth are outdated, gamed, or gatekept. TRUF is rebuilding trust from the data up.

Day 71 of 100 Days of TRUF

You’ve been lied to.

You’ve been told we just need “oracles.” That if someone pushes data on-chain, we can build the future of finance. That’s the lie that has stalled prediction markets, crippled DeFi, and left real-world asset protocols clinging to centralized feeds like life support.

Truth isn’t a feed. It’s a system.

And the systems we’ve relied on to resolve outcomes - across oracles, courts, human votes, even “trusted committees” - are failing to deliver what this new internet capital system needs most: verifiable, real-time truth.

First, What’s a Resolver?

In prediction markets, derivatives, indexes, and oracles, a resolver is what determines the “truth” of an outcome:

- Did inflation rise this month?

- Who won the US election?

- Is the ETH price above $5,000?

- Has the shipment arrived in port?

These truths have real financial consequences. Whoever controls the resolution controls the payout.

So... who are we trusting?

💣 The Problem with Today’s Resolvers

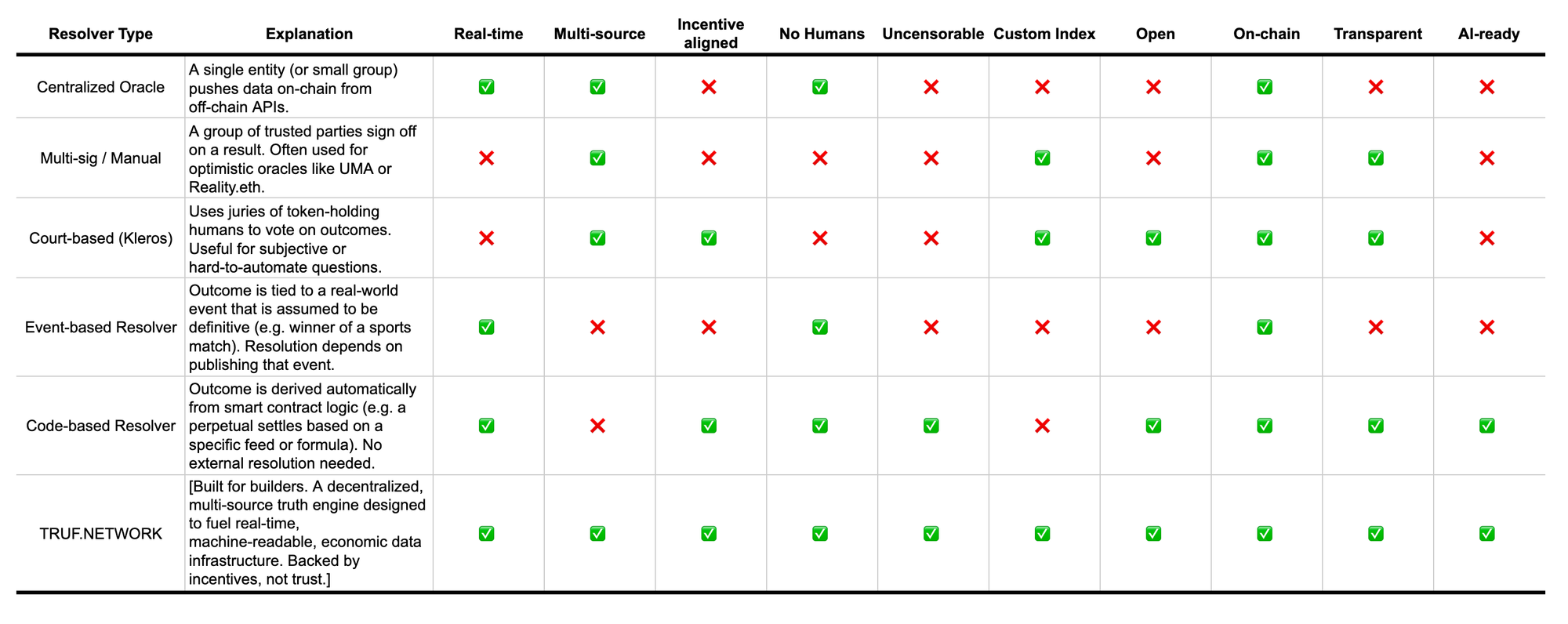

We broke it down in the chart below—you’ll want to screenshot this:

The TRUF Difference

TRUF.NETWORK is the resolver infrastructure for the internet of capital.

- Built for speed – Real-time resolution, not multi-day governance.

- Built for scale – Hundreds of data sources, not one.

- Built for machines – AI agents, autonomous apps, smart contracts.

- Built for you – Anyone can build an index, contribute data, or run a validator.

This is about establishing truth in a system that can’t function without it, not just the numbers.

Use Cases Already Live

- Truflation uses TRUF to publish real-time inflation and other major economic data across the U.S. and global markets.

- Index.fun builds decentralized “trend to trade” indexes with TRUF as the backend resolver.

This is working. Now it's time to scale it.

Who Should Care?

- Builders: Want to launch a prediction market, a synthetic asset, or a better CPI index? You need verified, live, trusted data.

- Investors: We're infrastructure, not just data. And infrastructure captures value at every layer.

- Agent Developers: Autonomous agents don’t call APIs. They rely on verified data streams with known provenance.

The old resolver stack wasn’t built for this.

TRUF.NETWORK is.

TL;DR

You can’t build the future of finance on broken resolvers.

You need a source of truth. You need TRUF.